Dubai Maintains Top Global Ranking For Attracting Greenfield FDI Projects In H1 2023

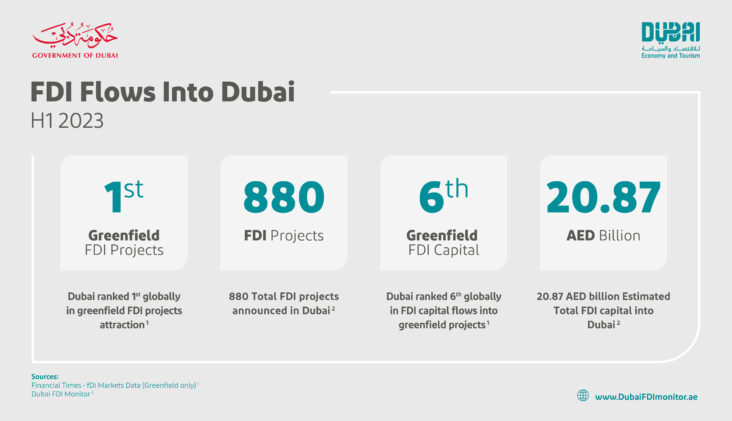

Dubai remains the top global destination for attracting Greenfield Foreign Direct Investment (FDI) projects, with the emirate attracting 511 Greenfield projects in H1 2023, as per Financial Times ‘fDi Markets’ data – the comprehensive online database on cross-border greenfield investments.

Dubai continues to set new benchmarks in global performance as an investment destination, surpassing second-placed Singapore by 325 projects. During the first half of 2023, Dubai’s global share in the attraction of Greenfield FDI projects stood at 6.58% – up from 3.83% over the same six-month period last year. The results, which underscore the emirate’s status as a key investment hub, aligns directly with the city’s 10-year Dubai Economic AgendaD33, which aims to double the size of the emirate’s economy over the next decade.

His Highness Sheikh Hamdan bin Mohammed bin Rashid Al Maktoum, Crown Prince of Dubai and Chairman of The Executive Council of Dubai, said: “Dubai’s ability to maintain its top ranking in attracting Greenfield FDI projects reflects the city’s ability to create unparalleled growth opportunities and value for global investors. Guided by the visionary leadership of His Highness Sheikh Mohammed bin Rashid Al Maktoum, Vice President and Prime Minister of the UAE and Ruler of Dubai, the emirate has intensified its drive to accelerate economic diversification and innovation. This commitment, coupled with the adoption of advanced technologies, is shaping a future filled with endless opportunities for progress and prosperity. With the clear growth roadmap set out by the Dubai Economic Agenda D33, we continue to work to create an investment environment that not only wins the trust of investors from all over the world but also encourages them to contribute to Dubai’s transformation.”

In parallel, new data released by Dubai FDI Monitor at Dubai’s Department of Economy and Tourism (DET), shows the city logged a total of 880 announced FDI projects between January and June of this year, a year-on-year growth of 70%. The Dubai FDI Monitor tracks, substantiates and analyses all types of FDI projects announced within the emirate.

Dubai FDI Monitor data also indicates that Dubai’s Greenfield FDI projects account for 65% of total announced FDI projects. The report also states year-on-year Reinvestment FDIs increased from 3% to 4.4% when comparing H1 2023 with the same period in 2022.

Meanwhile, Dubai also saw a year-on-year rise in global Greenfield FDI capital attraction, reaching AED20.87 billion (USD5.68 billion). According to Financial Times Ltd. “fDi Markets” data, Dubai climbed from eighth in H1 2022 to sixth globally in H1 2023,

Additionally, Dubai ranks first globally in the attraction of HQ FDI projects, according to Financial Times Ltd. “fDi Markets” data, by attracting 33 HQ projects in the first half of this year, ahead of London and Singapore. The achievement further highlights the emirate’s rising profile as a global hub for the headquarters of leading companies.

His Excellency Helal Saeed Almarri, Director General of Dubai’s Department of Economy and Tourism, commented:“We are continuing to accelerate efforts to deliver the Dubai Economic Agenda D33 launched by His Highness Sheikh Mohammed bin Rashid Al Maktoum, Vice President and Prime Minister of the UAE and Ruler of Dubai.

“As we work to enhance the city’s competitiveness and business environment internationally, these strong increases in announced FDI projects for H1 2023 drive home how our progressive policy enablers and diverse attraction programmes are resonating with global investors and decision makers alike.”

The Financial Times Ltd. “fDi Markets” data also shows Dubai rose from ninth in H1 2022 to fourth place globally in H1 2023 in employment creation from FDI projects. The climb follows a 43.3% surge in job creation in H1 2023 compared to H1 2022, equating to a total of 24,236 jobs created through FDI.

In line with DET’s economic diversification initiatives, Dubai’s efforts to retain and attract highly skilled talent were illustrated in the top six sectors contributing to estimated job creation by FDI in H1 2023: Business Services at 5,212 jobs (21.5% share), Software and IT at 3,525 jobs (14.5%), Food & Beverages at 3,090 jobs (12.7%), Financial Services at 1,813 jobs (7.5%), Consumer Products at 2,104 jobs (8.3%) and Real Estate at 921 jobs (3.8%).

Dubai FDI Monitor states the emirate continued to attract medium-to-high-technology and low-technology FDI projects in H1 2023, with rates of 63% and 37%, respectively, unchanged from last year. The data illustrates the prevalence of medium-high technology FDI ventures in Dubai, underscoring the city’s status as a global hub for cutting-edge FDI projects and a nexus for specialised talent in the digital economy.

In terms of key sectors bringing FDI capital into Dubai, Financial Services (52%), Business Services (12.8%), Software & IT Services (7.5%), Real Estate (6.9%) and F&B (3%) lead the way. The Dubai FDI Monitor showed the top five sectors accounted for 82% of total FDI capital inflow and 70% of total FDI projects. Leading sectors by FDI projects include Business Services (22.4%), Software & IT (17.8%), F&B (12.2%), Financial Services (9%) and Consumer Products (8.3%).