Gulf Capital portfolio company Geidea becomes first and only non-bank institution in Saudi Arabia to receive a merchant acquiring license from the Saudi Central Bank (SAMA)

Posted by Kübra ÇobanoğluGeidea, the largest fintech company in Saudi Arabia by market share, recently became the only non-bank institution in Saudi Arabia to be granted an acquiring license from Saudi Central Bank (SAMA). The license enables Geidea to process secure, fast and seamless end-to-end payment solutions directly to merchants.

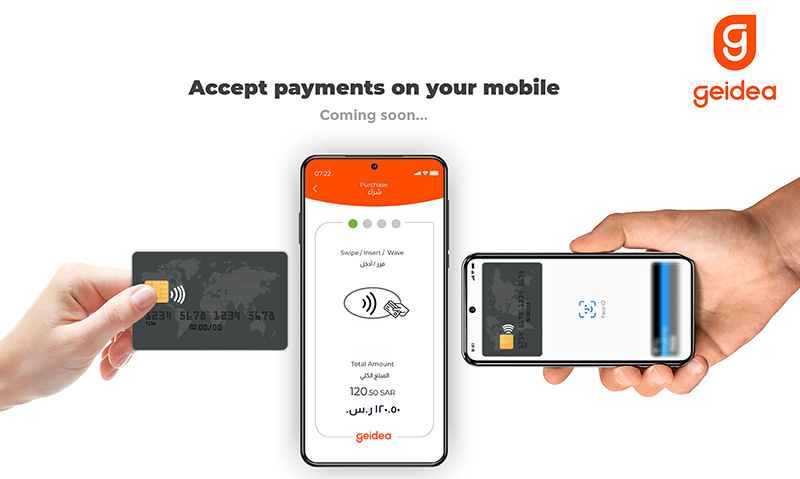

Furthermore, geidea becomes the first fintech in the region to develop an app based contactless ‘Tap on Phone’ solution which will empower SMEs with a simple and intuitive way to process customer payments. The app based Tap on Phone solution will allow merchants to quickly and securely accept payments on their mobile phones without the need for a separate payment terminal or connection.

The new Tap on Phone solution will also have all the features of a traditional PoS (Point of Sale) terminal, including acceptance of payments from contactless cards, mobile wallets, and wearable devices. All transactions are settled directly in the Geidea app on the merchant’s mobile phone and funds can be automatically transferred into their existing bank account within the same, or next day – easing the way of doing business in the Kingdom and improving convenience for both merchants and customers alike.

Additionally, it will enable business-owners with the capabilities to track and manage their sales, transactions, revenues and costs, thereby supporting SMEs in not only processing payments but also running their operations and ensuring their long-term business growth and sustainability.

“As a homegrown brand, Geidea is proud to be the first non-bank company to have ever received an acquiring license from the regulatory authorities. We thank Saudi Central Bank (SAMA) for supporting our innovation, and we strongly believe we can empower the growth of the SME sector while at the same time helping Saudi’s Vision 2030 goal of shifting towards a cashless economy. Additionally, with over 85% smartphone penetration in KSA, the development of ´Tap on Phone´ mobile payment acceptance will help realize our vision of making payment technologies accessible, affordable and intuitive for SMEs. No matter what merchants do, or where they sell, we can provide them with new and easier ways of accepting digital payments that fit the way they do business,” said Founder and Chairman Abdullah Al-Othman.

Geidea currently offers a complete suite payment solutions for SMEs, featuring portable payment card readers, smart terminals, ePOS systems for retail and restaurants, as well as giving online merchants and solo-entrepreneurs a complete e-commerce offering, ranging from building their own website, integration of payment gateway to their existing websites and ability to accept payments remotely anywhere in the world via payment links.

“At Saudi Payments, we are proud of our role to pave the way for banks and fintechs, enabling them to provide new and innovative services in the payments sector within the Kingdom, in a manner that simulates the innovation spirit that characterizes this vital sector. We look forward to seeing Geidea and other payment companies licensed by SAMA to complement our efforts to encourage the acceptance and adoption of digital payments in the Kingdom, and to actively contribute to completing the transformation of SMEs to adopt electronic payment methods, in order to achieve our ambition to shift towards a cashless economy,” said Fahad Al-Aqeel, CEO of the Saudi Payments Company.

All of Geidea´s contactless, ecommerce and online payment solutions are open and made available to both Geidea´s existing banking partners in Saudi Arabia, as well as offered directly to merchants and SMEs across various sectors, including taxi, ride sharing, food delivery services, home service, health and beauty, small retail and restaurants across the kingdom. The company aims to rollout the service across additional markets in the Middle East and North Africa by the end of 2021.