Dubai Office Sector Thrives In Q1 2024 Amid Strong Regional Activity

Savills, an international real estate advisor, released the Dubai Office Market report for Q1 2024, which revealed an upward trajectory, buoyed by a resilient regional economic rebound and strong demand from overseas investors and businesses. Other factors in the thriving office market were the city’s business-friendly initiatives, such as full foreign ownership, changes in residency visa rules, and support for tech firms through platforms like FinTech Hive, Dubai Technology Entrepreneur Campus, and C3 Social Impact Accelerator, which continued to attract global investors and businesses to establish a regional business hub.

Influx of new companies and expansion of current tenants

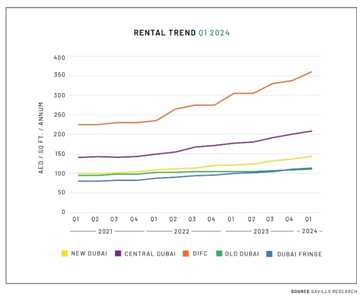

Demand for office spaces, particularly in areas such as DIFC, witnessed significant growth driven by new companies entering the market and existing occupiers expanding. This high demand, coupled with a limited vacancy of an average of 3%, led to an average 6% quarterly rental increase. Other premium developments in the submarket experienced a rental spike of nearly 30% year on year. However, all submarkets, especially Free Zoneslike Dubai Internet and Media City, Expo City, and DWTC, are witnessing considerable activity.

Demand for flexible office spaces increases

Dubai is experiencing rising demand and a trend for flexible or serviced office spaces, which is causing the office market to expand, exacerbating the supply-demand imbalance. This trend, combined with record-high new company registrations, presents challenges for firms looking for high-quality office space across the market.

“We are seeing a rise in demand for flexible and serviced office spaces, which has resulted in expansion by existing operators in the market already, such as ServCorp, IWG, and the Executive Centre. In addition, we are seeing a raft of new operators entering the Dubai market for the first time.”

Paula Walshe, Director of Transactional Services at Savills Middle East, added, “The surge is primarily driven by new businesses establishing operations in the city, which often find these flexible spaces better suited for their initial phase of business development than traditional offices. Simultaneously, we have witnessed the global trend of existing occupiers transitioning to serviced office spaces to adopt more flexible work models and mitigate significant capital investment for the fit out of transitional space.”

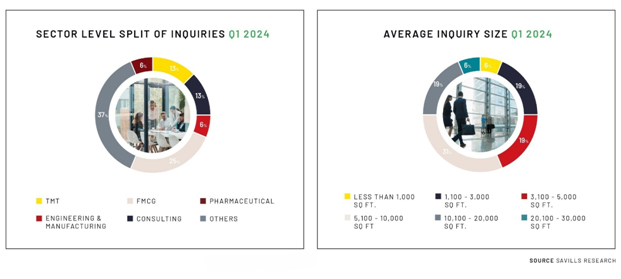

Legal services, wealth management, and TMT companies dominate the market

The market has seen a significant uptake of space by sectors such as legal services, wealth management, and technology, media, and telecommunication (TMT) companies during the review period, with companies from Singapore, China, and the UK leading the leasing activity.

Market dynamics were mostly influenced by new companies entering the market and existing ones expanding their current operations. Companies likeHawksford, Bfinance, Capital.com, Danfoss, Atoz, Additiv, and others have established their presence in Dubai in Q1 2024.

A shortage of Grade A spaces and high demand drive up rents

A shortage of Grade A spaces and high demand drive up rents

Landlords are offering reasonable rent-free periods for shell and core spaces, but incentives are becoming less generous for fitted spaces or lease renewals. Despite recent completions like Uptown Tower and 6 Falak in Dubai Internet City, the shortage of Grade A spaces remains a challenge, driving rental values up by 14% on average year-on-year, with some markets such as Jumeirah Lake Towers, Business Bay, Dubai Marina, One Central, and DIFC seeing an even higher rental growth of 20% to 30%.