Mashreq Posts AED 450 Million Net Profit For 1Q 2020

Mashreq, one of the leading financial institutions in the UAE, today has reported its financial results for the first quarter ending 31st March 2020.

Key highlights [1Q 2020 vs 1Q 2019]:

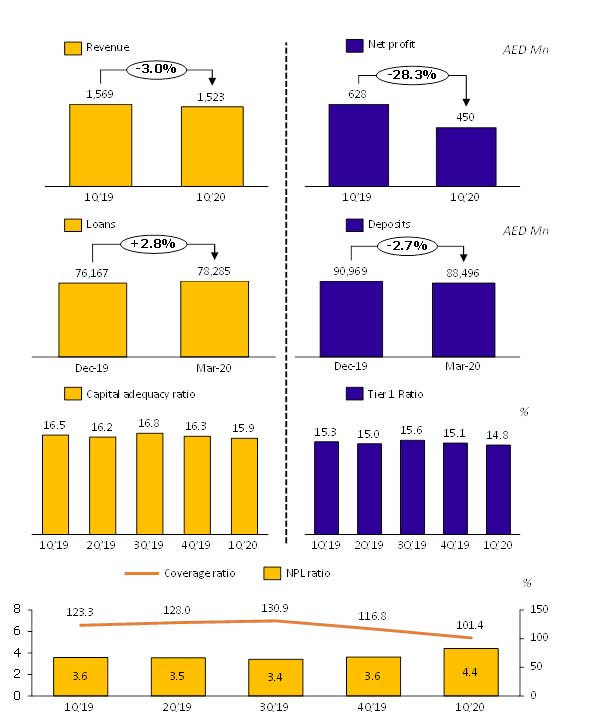

- Stable Revenues

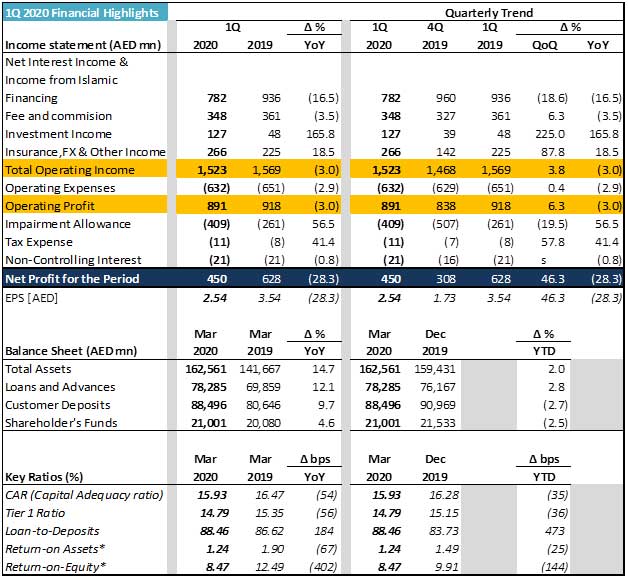

- Operating Income for 1Q 2020 stood at AED 1.5 billion, slight decline compared to last year.

- Net Profit for the quarter stands at AED 450 million

- High proportion of non-interest income

- Mashreq’s best-in-class non-interest income to operating income ratio increased to 48.7% vs 40.4% in 1Q 2019

- Significant growth in Investment Income (AED 127 Mn in 1Q 2020 vs AED 48 Mn in 1Q 2019)

- Solid liquidity & Capital position

- Liquid Assets ratio stood at 31.8% with Cash and Due from Banks at AED 2 billion as on 31st March 2020

- Capital adequacy ratio and Tier 1 capital ratio continue to be higher than the regulatory limit (15.9% and 14.8% respectively)

- Prudent Balance Sheet Growth

- Total Assets grew by 2.0% to AED 162.6 billion while Loans and Advances increased by 2.8% to reach AED 78.3 billion as compared to December 2019

- Customer Deposits reduced by 2.7% to AED 88.5 billion

- Loan-to-Deposit ratio remained strong at 88.5%

- Controlled Asset Quality in a Volatile Market

- Non-Performing Loans to Gross Loans ratio increased to 4.4% in March 2020 vs 3.6% in December 2019

- Total Provisions for Loans and advances reached AED 4.3 billion, constituting 101.4% coverage for Non-Performing Loans

Exhibits:

Financial Highlights:

*Annualized